Riding the Wave: Top Nigerian Cities for Real Estate Investment in 2025

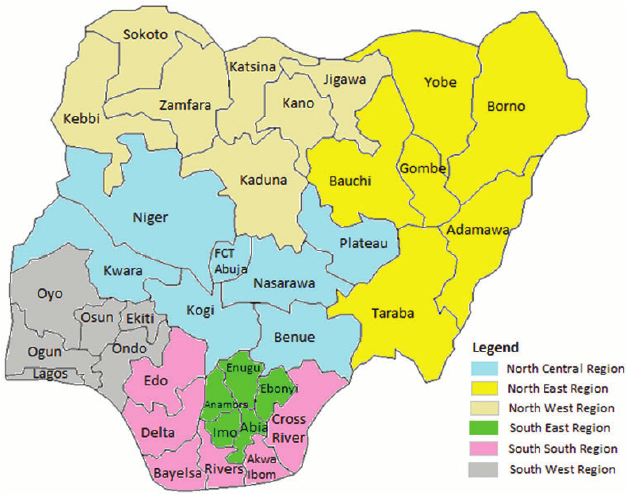

Nigeria’s real estate market is a dynamic landscape, presenting both challenges and significant opportunities for investors. As we look ahead to 2025, several cities are poised to offer particularly compelling prospects. While Lagos remains a powerhouse, this post delves into other Nigerian hubs, exploring their investment trends, emerging neighborhoods, and growth opportunities. Let’s explore why Abuja, Port Harcourt, and Enugu deserve a spot on your investment radar.

Beyond Lagos: Why Diversify Your Nigerian Real Estate Portfolio?

While Lagos’s market might be the most talked about, diversifying your portfolio across different cities can mitigate risk and unlock new growth potentials. Cities like Abuja, Port Harcourt, and Enugu offer unique advantages stemming from government policies, growing populations, and infrastructure developments. This means potentially higher returns for savvy investors.

1. Abuja: The Federal Capital with Consistent Growth

Abuja, Nigeria’s capital, continues to attract significant investment due to its planned infrastructure, relatively higher disposable incomes, and a growing expatriate population. Here’s why Abuja is a hot prospect for 2025:

Investment Trends:

• High-End Residential: Demand for luxury apartments and gated communities is consistently high, catering to government officials, diplomats, and affluent Nigerians.

• Commercial Properties: Office spaces, retail outlets, and hospitality establishments are experiencing growth driven by the city’s administrative and business functions.

• Land Acquisition: Investment in undeveloped land, especially on the city’s outskirts, remains a popular long-term play with significant appreciation potential.

Emerging Neighborhoods:

• Jahi & Kado: These areas are rapidly developing with a mix of residential and commercial properties, thanks to increased infrastructure projects.

• Life Camp & Gwarinpa: Already established neighborhoods are witnessing further development, becoming popular choices for middle- to upper-class residents.

• Lugbe: As a growing satellite town, Lugbe offers more affordable options while maintaining good connections to the city center.

Growth Opportunities:

• Infrastructure Development: Ongoing road construction, transportation projects, and expansions in power supply bode well for property value appreciation.

• Political Stability: As the seat of government, Abuja enjoys a relatively stable political environment, attracting more investors.

• Expanding Middle Class: A growing middle class in Abuja fuels demand for quality housing, supporting continuous growth in the rental and sales market.

Local Expert Insight: According to Ibrahim Ahmed, a prominent real estate developer in Abuja, “The city’s steady growth and infrastructural developments are creating prime opportunities for both residential and commercial investors.”

2. Port Harcourt: The Oil City Rebounding

Port Harcourt, the hub of Nigeria’s oil and gas industry, is experiencing a resurgence after periods of instability. This makes it an interesting option for investors willing to take a calculated risk with high potential returns.

Investment Trends:

• Residential Properties: Demand is rising for modern apartments, family homes, and secure gated communities as the city becomes more appealing to professionals.

• Commercial Retail: Shopping malls, business centers, and supermarkets are growing to cater to a young and affluent population.

• Industrial Properties: Warehouses, processing facilities, and logistics hubs are in demand to support the oil and gas and related industries.

Emerging Neighborhoods:

• GRA (Government Reserved Area): As one of the oldest and most prestigious neighborhoods, it continues to command premium prices.

• Trans Amadi Industrial Area: An increasingly important location for commercial and industrial investment, with potential for high rental yields.

• Peter Odili Road & Eliozu: These areas are witnessing rapid development with a mix of residential and commercial properties.

Growth Opportunities:

• Economic Diversification: Initiatives aimed at diversifying the economy away from oil are creating new investment avenues in other sectors.

• Improved Security: Increased efforts to address security concerns are making the city a more attractive investment destination.

• Young Population: A large and youthful population is driving demand for housing and creating a dynamic consumer market.

Local Expert Insight: Chinedu Eze, a real estate consultant in Port Harcourt, notes, “With ongoing efforts to improve security and diversify the economy, Port Harcourt is bouncing back, presenting lucrative investment opportunities.”

3. Enugu: The Coal City with Quiet Potential

Often overlooked, Enugu is quickly becoming a hidden gem for real estate investment. Its stable environment and rising population make it a compelling option.

Investment Trends:

• Residential Housing: There is a growing need for quality and affordable housing, with a focus on gated communities and apartments.

• Student Housing: Due to the presence of several universities and tertiary institutions, student accommodation is a profitable niche.

• Small-Scale Commercial: Local markets, shops, and business centers are witnessing a surge in demand, reflecting the city’s economic development.

Emerging Neighborhoods:

• Independence Layout & GRA: Established neighborhoods offering premium living options.

• New Haven: A rapidly developing area attracting both residential and commercial investors.

• Emene: Near the airport, Emene offers more affordable options while experiencing significant growth.

Growth Opportunities:

• Stable Environment: Enugu is known for its relatively peaceful environment, which makes it attractive to investors seeking stability.

• Lower Land Prices: Compared to Lagos and Abuja, land prices in Enugu are still relatively affordable, presenting opportunities for high-return investments.

• Tourism Potential: Enugu is increasingly being recognized as a potential tourist destination with attractions like the hills and parks, opening opportunities for hospitality.

Local Expert Insight: Ngozi Okafor, an Enugu-based property manager, highlights, “Enugu’s peaceful environment and lower land prices make it an attractive destination for both new and experienced investors.”

Final Thoughts:

Investing in Nigerian real estate in 2025 presents exciting possibilities. While Lagos remains a powerhouse, exploring cities like Abuja, Port Harcourt, and Enugu can diversify your portfolio and offer higher returns. Remember to conduct thorough due diligence, understand local market dynamics, and consult with experienced professionals before making any investment decisions. The key is to identify emerging trends and strategic locations to capitalize on the opportunities these cities have to offer.

Call to Action: Ready to explore these investment opportunities? Contact our team of real estate experts today to get personalized advice and start your journey towards profitable real estate investment in Nigeria.